Acquisition project | The Baking Club

Cloud Kitchen Model - QSR Category products

ICP (Ideal Customer Profile) { Bangalore, Mumbai, Delhi, Hyderabad }

| ICP1 | ICP2 | ICP3 | ICP4 |

|---|---|---|---|---|

| ||||

Age | 28 - 40 | 25 - 40 | 18 - 30 | 22 - 40 |

Goal | Knows what to order, waste less time in the food ordering process, consistency, trust | Quick order, More options | Affordable, quick, consistency, Meal options, Knows what to order, Value for Money | It should serve as a proper meal, Serve the Western / Indian cravings in a quick way |

Gender | Male/Female | Male/Female | Male/Female | Male / Female |

Location | Tier 1 | Tier 1 | Tier 1 | Tier 1 |

Pain | Customer Support | Lacking Awareness, not sure what to order | Minimum order value is high, fear of experimentation | Minimum order value is high, fear of experimentation, not sure what to order, Customer Support |

Current Solution | Family Restaurant, Restaurant specific apps of renowned chains ( Dominos, Mojo Pizza, McDonalds) | Restaurants on Zomato, Swiggy like Faasos, Rollzone etc | Offerings by Box 8, Eat.Club, Curefoods | Zomato, Swiggy |

Apps | Twitter, Linkedin, G Maps, Letterboxd, Spotify, Apple Music, WhatsApp, Dating Apps | Twitter, Instagram, LinkedIn, Youtube, WhatsApp, Dating Apps | Twitter, Instagram, Uber, WhatsApp, Dating Apps, Spotify, Apple Music, LinkedIn, | Twitter, Instagram, Uber, LinkedIn, Youtube, WhatsApp, Dating Apps |

Calculating TAM/SAM/SOM

( Considering the Monthly metrics for ARPU and number of orders/TG )

TAM

ARPU (Average Revenue Per User) - 500 INR

Indian Targeted Population ( TG ) - 2 * (10^6) per city

{ People earning >= 5-8 lakhs per annum, Age Group <-> 20-40, 4 Tier 1 cities }

TG * ARPU = 50 Million USD ( 400 Cr INR )

As per News the TAM was close to 1000 Million USD for 2023 for the Cloud kitchen industry, so we are targeting the audience as per the category of our products and also the age group constraint looking out for those products majorly.

SAM

ARPU (Average Revenue Per User) - 500 INR

Indian Targeted Population ( TG ) - 4 * (10^5)

{ People earning >= 5-8 lakhs per annum, Age Group <-> 20-40, 4 Tier 1 cities }

TG * ARPU = 2.5 Million USD ( 20 Cr INR )

SOM

ARPU (Average Revenue Per User) - 500 INR

Indian Targeted Population ( TG ) - 1 * (10^5)

{ People earning >= 5-8 lakhs per annum, Age Group <-> 20-40, 4 Tier 1 cities }

Dessert/Bakery Products and creating a new product category - 25000 order / month with a AOV of 500 INR in a single Tier-1 city

TG * ARPU = 0.625 Million USD ( 5 Cr INR )

Current Market Capture in Online Channels :

ARPU (Average Revenue Per User) - 300 INR

Indian Targeted Population ( TG ) - 25 * (10^3)

{ People earning >= 5-8 lakhs per annum, Age Group <-> 20-40, 1 Tier 1 cities }

Dessert/Bakery Products and creating a new product category - 700 order / month with a AOV of 500 INR in a single Tier-1 city

TG * ARPU = 2.1 Lakh INR

ICP Prioritization :

- Adoption :

This will be higher in the age range of 18 - 35, as the users are open to experimentation, decision makers degree is low ( 1 or 2 ) generally, higher likeability towards the category of QSR range, higher social media awareness and topics of discussion are around the market trends. Visit different events and have more time for socializing, so WOM will be more effective.

- Frequency usage :

The frequency of online ordering will be higher for folks that are in the age range of 21 - 30, considering the majority is living away from home and are bachelors, spend less time / resources to cook food and focused more on their work ( leveraging the Indian audience mindset and ecosystem ), core users of Zomato / Swiggy and other online ordering platforms. - Appetite to Pay :

For F&B this will be highly dependent on the "value for money" and differentiating factors that will make customer to re-think the brand positioning amongst the other brands. If the experience that customer is going to have is in the online delivering, that's what this brand is in closed community build-up and strong WOM referral will be required to acquire customers to market the product & brand. So we kept the pricing competitive so as to position the brand among other well known QSR product categories like Burgers / Pizzas / Taco etc. - TAM :

Cloud kitchen Industry TAM as calculated for our products range is 400 Cr, acquiring the customers that are experience driven and focused more on the job getting done without much waste of time ( Quick ordering amidst the wide range ). So out of the actual TAM that will be somwhere close to 100 Cr which is greater than SAM/SOM still allowing to segment the users. - Distribution Potential :

The initial build up of revenue channels and marketing the product is well positioned for the large group of gatherings of different community events ( 50 - 150 Pax ). Also, the product range is mainly the high shelf life products so building out different product verticals by performing the R&D will help the product footprint expansions and keeping the fixed cost in limits. Products positioning goes well with different high customer footprint events where the "Appetite to Pay" is huge, so "Zomaland" powered by Zomato is one of the spaces where the customers are for experience and making the day memorable eventually allowing the brand to showcase its "Value for money" and a new experience amongst the well established brand will allow the brand to make decisive calls on area wide expansion and building out a strong WOM lowering the CAC eventually.

ICP 3 :

- So as per our ICP buckets, the ICP 3 will be strongly related with the above 5 factors allowing the brand to channelize and perform the right marketing campaigns.

ICP 4:

- Another priority in ICP will be these customers as it strongly correlates with the 4 out of 5 factors from above.

ICP 1 / 2 :

- These both correlates with 3 out of 5 factors and demands higher CAC initially.

JTBD ( Jobs to be Done )

Job | Goals |

|---|---|

| |

Functional |

|

Market Research

Rebel Foods Case Study :

- After talking to users, the owner realised 70 % of customers had never entered the outlet, i.e., the web and phone delivery business was indeed growing independently of the stores, and hence the idea of having a store was holding no value.

- The Company moved from being just a single brand restaurant to a parent company with a dozen restaurant brands under the umbrella. You can think of Rebel Foods as a single factory that is churning out multiple brands as products.

- The massive advantage for Rebel foods or rather the cloud kitchen model is innovation. They opened a series of brands within a short span of time because they were able to leverage the existing facilities to build a new product along with scale. They were able to experiment without the fear of committing much in terms of both time and value.

- Anyone in this place would have started with Pizza but he knew that the market was dominated by Domino’s and Pizza Hut. In 2017 after acing both these brands he went back to Pizza and launched four variants unique in their own way.

This is where the category creation and different food variety comes in place, which demands for innovative solutions and that's where "The Baking Club" was trying to tap the market.

- By 2020 Rebel foods had about 12 brands under its umbrella, with the coffee brand Slay the latest addition. The top 3 brands in Rebel Foods’ portfolio are Faasos, Behrouz Biryani, and Over Story, while others are catching up fast.

- Once Rebel Foods shifted to the new business model, many opportunities and options opened for them, and the company expanded exponentially. Rebel foods opened about 50 cloud kitchens spread across four cities in a span of 2 years, and by the end of 2020, they had about 320 cloud kitchens with a presence in 35 cities.

Cure Foods :

- Curefoods follows the Thrasio-style model of business. Thrasio refers to the name of a company in the United States. This company acquires or collaborates with small and successful sellers on e-commerce platforms like Amazon and invests more in those companies to make them huge and well established under a single brand name.

- Curefoods follows a similar pattern and has acquired a lot of small food startups across the country. The main idea behind this is to provide people with multiple options to choose their food based on their choices. Curefoods receives orders, cooks them, and delivers them to your doorstep.

Cure Foods "Thrasio Strategy" is what vision Foodizen India aimed for as the culinary innovation and optimzations re-invention should only be done whereever necessary. If brands like "Flippin Burger" are creating the new OS for the Burger category then it makes sense to follow the Cure Foods strategy.

Core value of the product / offerings

There are ton of options out there on different food delievering apps, what "The Baking Club" was trying to solve is the customer experience in the online delivery market. You must be wondering how ?

So we created a product called Baked Rolls (Fusion of Kathi Roll and Pizza ), and by using the fresh dough, design of the product and the packaging we solved the three pain points of the current online market -

- Food being warm for the longer period of time

- Higher Shelf life of the product helping to reheat the product and eat after 15-18 hours

- Value for Money and No fear of experimentation with the wide range

The below is the snapshot from Zomato Partner Dashboard after operating for close to 8 months, which showcases 4.3 rating and 261 Delivery reviews ( 95% of them were 5+ rated ) and deilvers close to 5000 orders across all channels.

Primary Goal is to acheive the SOM in next 6 months :

CAC Calculation :

Reelo subscription fees is 2000 / month so 24,000 annually and considering for other features might require some other integration as well so 40000 of spend annually.

Total Spend on the platforms semi-annually which involves below :

Reelo + other enablers = 40,000 INR

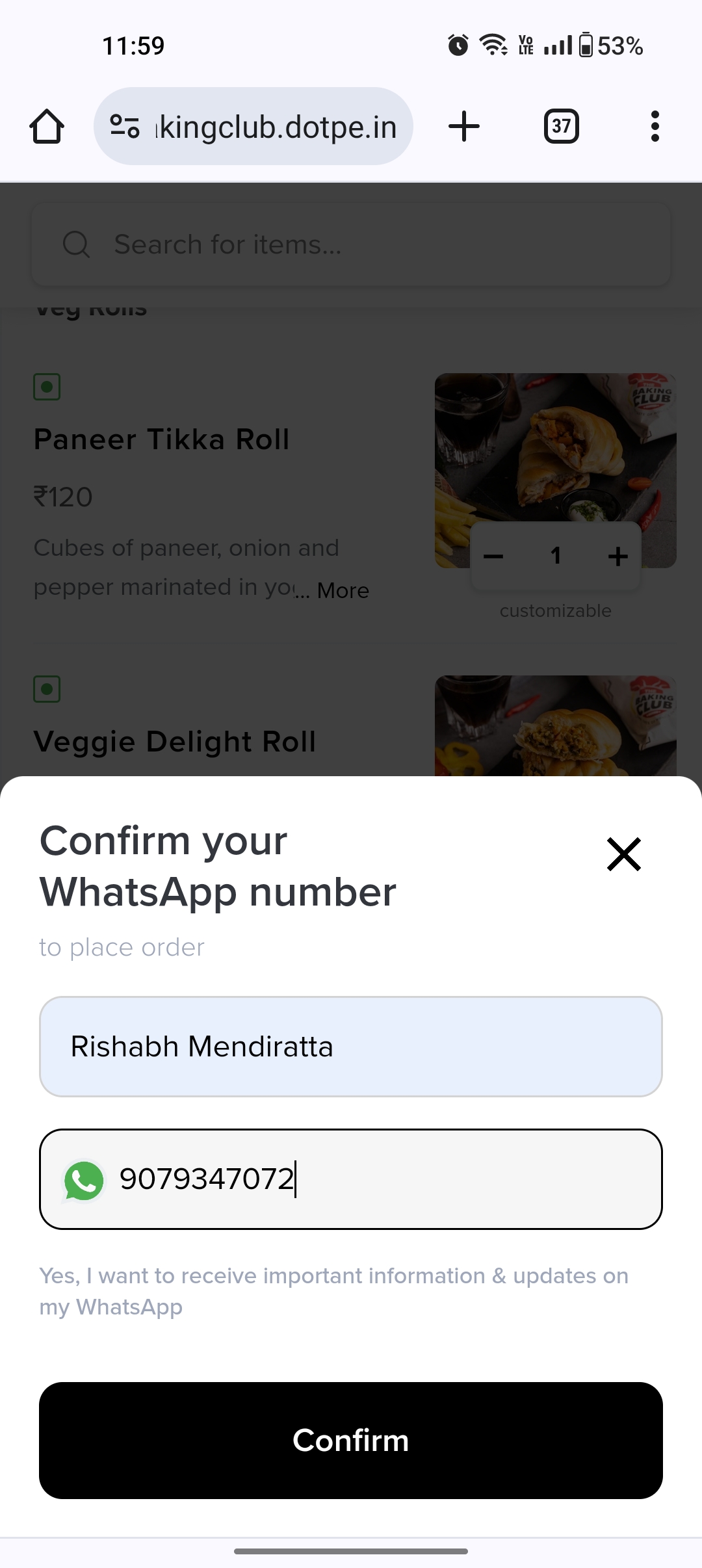

Customised website like Dotpe = 18,000 INR

Domain fee = 2000 INR

Offers Burn Semi-Annually = 5,00,000 INR

Packaging Cost = 3,00,000 INR

CAC = Total Spend / Number of stable users to acquire

9,60,000 / 25,000 = ~38 INR

Designing Acquisition Channels in the PMF stage :

- Offline channels --> Engaging more in communities like Draper Startup House to acquire the right audience and get feedbacks in the real time.

Draper Startup House is the VC/PE firm with a pre seed accelerator setup trying to marry the Co-working and Co-living spaces in the best possible away. So lot of events happen here like Tech Talks, Networking events etc. Our brand developed a great repo here and started getting referrals for the bulk orders. - All offline events won't make sense, doubling down on the spaces where the "Appetite to Pay" is dependent upon either the hosting org or the spaces where all high end brands put out their gameplay.

- Short Case Study to understand when and where the effort plays a role : Paris Panini is a brand which was acquired by " The Pizza Bakery ", given " The Pizza Bakery " is helping the brand to create offline stores but the founder can be seen in lot of events that targets audience those who are ready to pay and value the product. IMO, partially the brand is doing right by only visiting events that resonates their product with customer but the "Founder Brand" brand driven strategy is not right at this moment as the social media presence is not high, so I believe the focus of the founder should be different for this part and should spend time in different domains.

Online Channel Problem :

- As per the ICP analysis one of the pain point which I analysed is the customer support which can also be seen in the below image. Also, if we see for initial stage if the restaurant is in the high footfall area and giving feedback direct to restaurant helps to realise lot of end users demand, so this is a problem that calls for the exclusive solution to build a community of people and make them aware about the exclusive platform from where they can order online.

- So, here are three goals that needs to be resolved while addressing the pain points :

Trust <=> Exclusivity and building small feedback loops.

Lacking Awareness <=> People are not aware about the platforms other than Zomato/Swiggy

and also it calls for an extra effort, but what if I say that the customer support is going to be exclusive that will allow the brand to acquire customers more quickly.

Less Distraction <=> On market places if people are aware about what to order still gets distracted by offers or any other promotions. Acquiring audience that knows what to order and giving exclusive offers.

Below is the exclusive restaurant platform application powered by Dotpe (Web/Mobile) version that charges only 1% commission 1/30th of what Zomato/Swiggy charges, usage and discoverability is the hurdle to be resolved. Delivery partners connected to it are external Porter, Dunzo, Shadowfax etc. and the delivery charges are restaurant customizable and as the contract signed with these vendors.

Website edited for the Acquisition channel 2

Mobile Web App

Acquisition Channel 2 : ( Content Loops + Product Integration )

Problems being solved : Trust / Lacking Awareness / Less Distraction / Lower CAC / Customer Support

- Link the above portal with Social media channels ( Instagram / Twitter / Snapchat ) and once the order is completed folks can share the customised order snap with the community along with the order pic automatically tagging the brand page and eventually brand will run the loyalty for the customer retention.

Why to take this overhead and not just run insta, google ads and increase SEO ?

- Well it's a chicken egg problem from the high level but if we go deep inside and burn some cash on these platforms or any other digital media platforms like Adonmo campaigns, it's clear that food exploration and trust for the same requires different elements to capture.

- In the rapid evolution of technology, it's required to although gain attention of users at certain times of the day that being generally the ( lunch / snack / dinner ) for our product range.

- Also, a customer once acquired and the way to checkout the customer experience alongside expanding brand name without spending extra bucks will lead to acquisition of more customers and will also allow to track the geography, time, personas to build more product/brand specific campaigns/referrals.

Acquisition Channel 3 : ( Nas.io, Slack, Discord, WhatsApp <=> Close knit exclusive communities )

Problems being solved : Continuous interaction / Feedback / Lower CAC

- Customer demands transparency as what is going in the products that they consume and some customized services, building accessible channels for the customers from the comfort of the home.

- Easy to grab attention and gain feedback on new products, as the brand diversify the product range.

Evidence of scalability and alignment with the customer acquisition :

- As per the Rebel Foods, the business transformation from Offline to Online made sense for the people living nearby and making it easy for them to get delivered the products at home. Although incase of Rebel foods since they had a strong hold of 4 years offline operations which built a strong brand recall and go to brand for its frequent users.

- This is where leveraging the online community channels will play a role to minimize the 4 year window, and will be able to serve the larger audience instead of adding another headache of offline hospitality.

- Combining the offline pushing of products in the right spaces like Draper Startup House and other community event places that have some HNI as well visiting and also more of startup era folks those who understand the difference between the great and good product, eventually building out a personal community that can allow for focused marketing campaigns on Whatsapp and building visibility of brands alongside increased use of personal ordering channel.

Acquisition Channel 4 : WhatsApp Marketing

- Given the maximum users use whatsapp as their go to application for chat purposes and also users in 35-45 age group are less experimenting in nature, so acquiring new customers and retaining current customers on whatsapp will play a huge role by sending whatsapp promotions.

But how do we ensure that Whatsapp promotions / marketing have a good conversion rate and also people will actually use it ?

- Customer Support is the main pain point and if we see the Zomato/Swiggy channels given the large volume it gets difficult to serve each customers problem in an articulated manner and with a satisfying outcome.

- Providing users the exclusive and highly used channel with a hassle free denouement of the user journey will make the experience lifecycle more lucid and subconciously building the brand space in the user's mind.

- Another is the status feature of WhatsApp, since the audience that uses status more on WhatsApp want the closed community in their contacts to look at the accurate content and will be very much open once they get a great experience driven lifecycle that they will be open to brag about.

- So the brag worthyness of the brand will not just be the product instead the complete lifecycle that want in the online delivery and the giant marketplaces in the market deprioritizing them given the volume being large.

- This is where the daily proofs from different social media can be used on WhatsApp to make people realize the similar pain points of the other users, and why the community needs to expand to eventually build a platform for the public.

Product Integration

- Problems solved Brand Awareness / Organic Search:

- Convince one of the most used dating apps to add the best online food delivery brand and only allow to add from top 5 brands from the choices, will list "The Baking Club" amongst the key players like Rebel Foods, Box8, CureFoods and will list the "The Baking Club" hyperlink there.

But how will this play a role in customer acquisition ?

- As there are multiple factors that impacts the virtual date to become an actual date. One of them being the conversation around topics, given that the amount of audience that's on the dating apps, some segment of them will eventually talk about food either during the leisure time or maybe to break the ice that will come from the profile preferences. To have some data people will make an effort here if not for ordering but definetly for the conversations, and this will help to increase the search.

- Also while building the profile, if "Hinge" like brand is putting something out there it will play a huge trust game and will increase the search for the brand.

- Now since the name of brand is potentially getting infused in the conversations, this will build out a recall value and help design better campaigns after the analysis of traffic.

- This will play a key role in defining different ICP's that should be targeted and accomodated in the prioritisation.

Referral / Partner Design

Creating a strategy for the repeat orders & new customers

CAC will be higher as compared to the current application due to the loyalty rewards but serving all other purposes missing out while using Zomato and other online marketplaces, customer data will be available to run specific campaigns and stay closer to community.

- Use Reelo like software services to build a robust loyalty platform integrated with above ordering link

- Pull Factor <=> Cashbacks / Wallet credit points -> using the ( content loop + PI ) hack / sharing a referral coupon code to create account.

- Engagement/Exclusivity <=> Launching weekly most orders campaigns and offering 100% cashback to user wallets for top 5 users.

- Distracting users <=> Send email notifications as the most used apps amongst ICP's is Gmail, around the offerings / rewards and also the meme based engagement via email as people are generally looking Gmail in serious mode and adding an AHA/awestruck moment can divert the user from the actual work.

- Keep user engaged on WhatsApp by sending the notifications of the current wallet score, expiry time, current ongoing offers ( personal order link will have the advantage to create more custom coupons as compared to the online marketplaces ), top 5 users of the week and try to pull their testimonials as to build the trust on the loyalty/reward system.

- Develop a metric for users calling it "TBCult" that will be the combination of the number of times share of ( content loop + PI ) + number of referral shares.

- TBCult metric will give more customized discount coupons, full cashback policy in case of order delays, a complimentary treat on every alternate order and also a chance to tour our cloud kitchen unit along with end to end understanding of how it works.

- Referral Design to non users will be like a coupon code "TBC+<FIRST 4 LETTERS OF REFEREE>+<DOB>", and it will be very direct to create a account via multiple SSO(Single Sign On) to access the Email Id as to make sure the Email notification design is reaching to users.

Summarising Current User Journey on the Application :

Payment Integration Partners :

Current application doesn't support new age payment options used widely in Tier 1 cities like CRED which has a strong ecosystem in itself, including those will help people continue using the application and building a better closed loop of people acquisition/retention.

LEARNING THROUGH MY ENTREPRENEURIAL JOURNEY

Work with the right folks and a strong vision

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.